Choosing between paying off debts vs. investing for the future is a real headache! You have some extra money, but you’re unsure whether to save it for emergencies, pay off your major or minor debts, or put it toward an investment that will pay off in the future.

You aren’t the only one who bothers about this. Like you, many others have tons of debt to pay. Either choice is super reasonable, but this depends solely on the circumstances.

Become an insider. Subscribe to our newsletter for more top trending stories like this!

However, you can have your cake and eat it too. In other words, you can pay off debt and still be investing. And that’s awesome! But how do you handle paying off debt vs. investing?

We’re here to help with six tips for managing both simultaneously. Let’s get into it!

Paying off debts Vs. Investing, Which Should You Tackle First? These 6 Straightforward Tips Will Help You Handle Both!

1. Pay attention to high-interest debt

Debt with a high-interest rate is ultimately your worst enemy. It’s an unhealed financial wound that swells faster than you could earn in interest. You may end up paying more interest if you don’t keep track of your credit card debt. And with that money, you could have saved, invested, or paid off other debt!

2. Save

If you want to feel more secure about your financial future, paying off debt first (or at least giving it priority over investments) is necessary, but doing so means you will have less money saved up for other goals.

To compensate for this, try saving up a portion of each paycheck or any extra money from paying off debt into an investment account that earns money instead of a savings account. This way, even if you don’t have any spare cash on hand right now, you’ll have something to look forward to once you pay off your debt!

Your savings will also help you avoid incurring debt due to unplanned expenses or accidents.

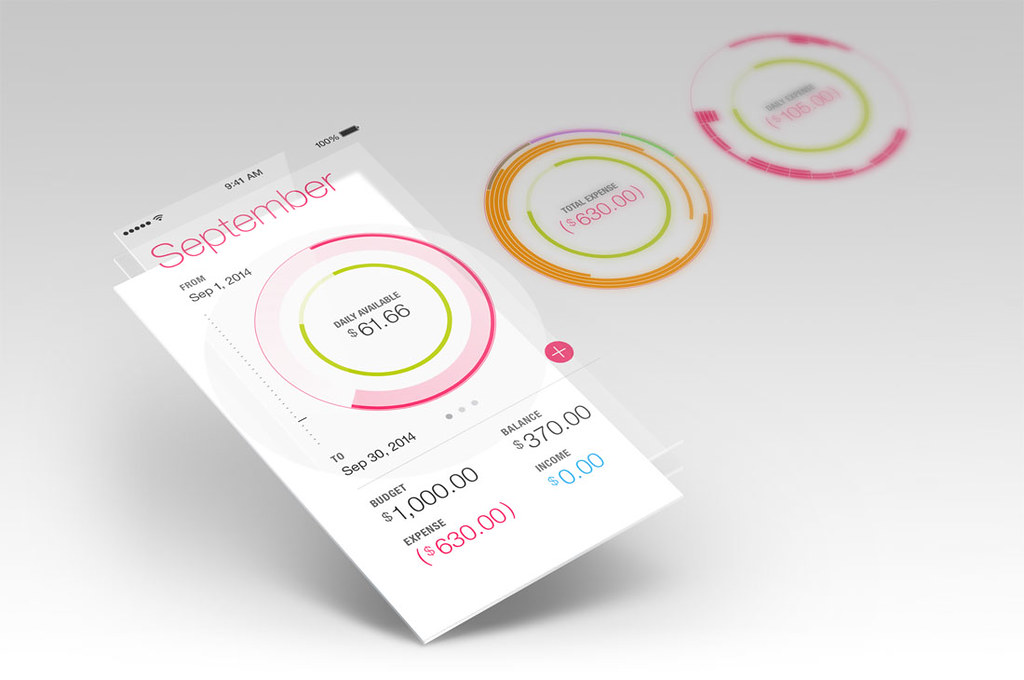

3. Track your expenses

Now that you have limited resources and a limited amount of money available for repayment, investing, and living expenses, be sure you’re keeping track of every penny you spend. Tracking your finances lets you know how much money is going out each month and where it’s coming from (the credit card statement) and assists in reducing unnecessary spending so that it doesn’t put an undue strain on your financial situation.

Become an insider. Subscribe to our newsletter for more top trending stories like this!

4. Create a budget and stick to it

I know you’re thinking: “I can’t get ahead if I’m paying off debt and investing simultaneously.” And yes, indeed, you can’t do both things at once. However, what you CAN do, is put yourself in a position of financial freedom where you can easily manage both activities.

After paying your monthly bills, how much do you have left? Are habits you need to cut off to reduce unnecessary spending? Create a monthly budget so you can know how much you need to pay your expenses, how much you have left over for savings, and how much you can use to pay off debt.

5. Make your minimum payments

At all costs, ensure you don’t miss your minimum payments. Generally speaking, you should avoid fees and penalties because they exacerbate your debt. Think of your debt’s minimum payments as fixed expenses. Your monthly living expenses should be your top priority, followed by minimum debt payments.

6. Aim for long-term investments

After you have paid off your high-interest debt, you can start making long-term investments. If you have a diversified portfolio, your assets may perform better than your lower-interest debt, allowing you to meet your financial goals while only having to make the minimum payments.

You can pay off your debts while investing if you choose the appropriate course of action. These suggestions can help you make significant progress toward debt management and reaching your financial goals. The only way to start clearing your debts and meeting your financial goals is to stop thinking about it and start doing something about it right away.

Become an insider. Subscribe to our newsletter for more top trending stories like this!